🎯 Lesson Objective:

By the end of this lesson, you’ll understand the four major account types that power an automated wealth system—401(k), Roth IRA, HSA, and taxable brokerage—and the core benefits and limitations of each.

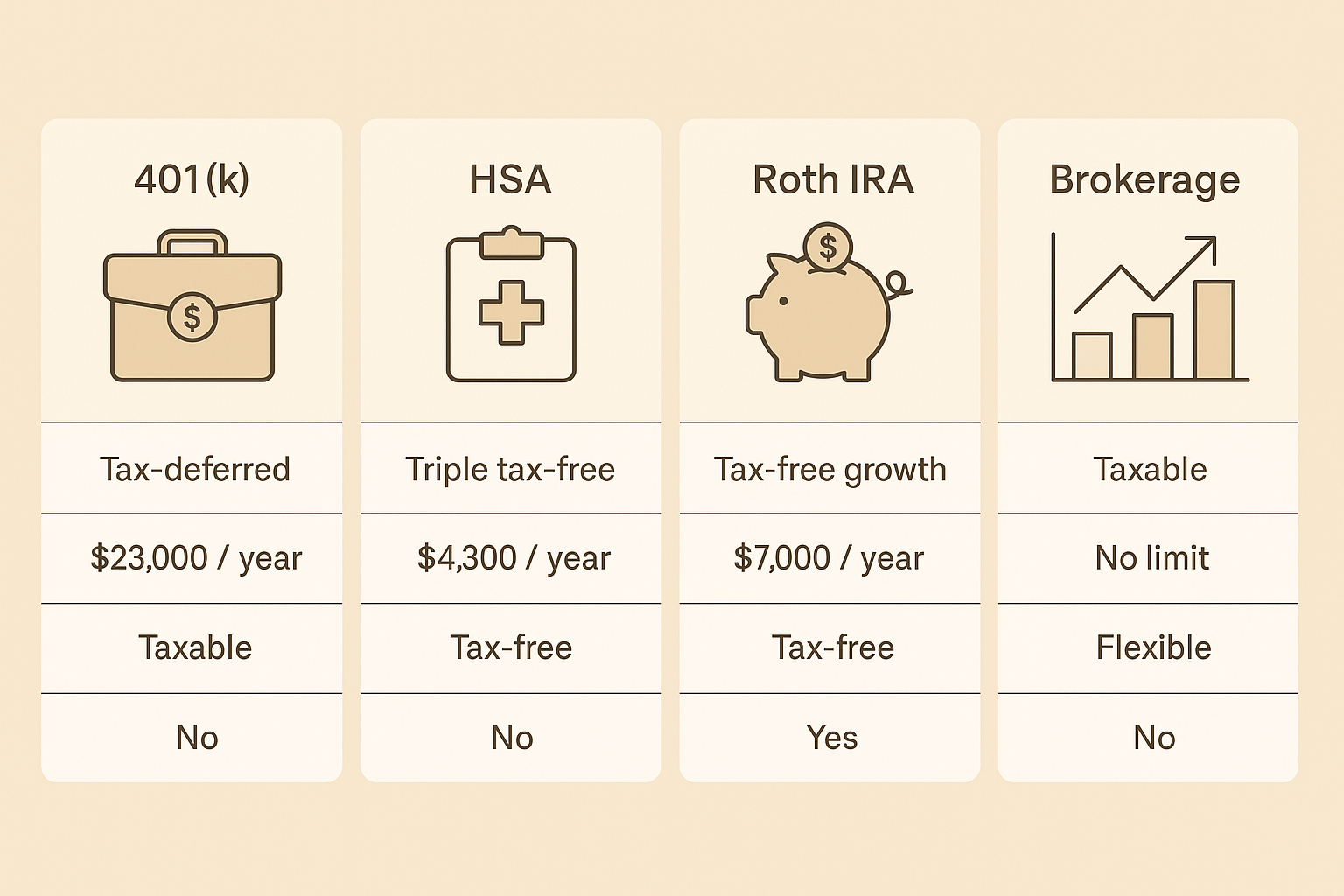

🧾 The Four Building Blocks of Your Wealth System

To build an automated money flow, you need to know which accounts you’re routing money into. These are the ones you’ll most likely use:

💼 1. 401(k) or 403(b)

What it is: A tax-deferred retirement plan offered through your employer

Why it’s valuable:

Contributions reduce your taxable income

Many employers offer a match (free money)

Investments grow tax-deferred

Limits (2025): $23,000 employee contribution; $69,000 total including employer match

Automation-friendly: Yes—contributions are taken directly from your paycheck

✅ Use it for: long-term retirement investing and employer match harvesting

🏥 2. HSA (Health Savings Account)

What it is: A triple-tax-advantaged account for people with high-deductible health plans

Why it’s valuable:

Contributions are tax-deductible

Growth is tax-free

Withdrawals for medical expenses are also tax-free

Bonus: After age 65, you can use it like a traditional IRA

Limit (2025): $4,300 individual / $8,550 family

✅ Use it for: stealth retirement investing and high-deductible plan optimization

🧾 3. Roth IRA (via Backdoor if needed)

What it is: A retirement account you fund with post-tax money

Why it’s valuable:

No taxes on growth or withdrawals (if rules are followed)

You can access contributions anytime (no penalty)

Great for early retirees and estate planning

Income limit workaround: Use the Backdoor Roth IRA if you earn too much

✅ Use it for: tax-free retirement growth and long-term flexibility

💰 4. Taxable Brokerage Account

What it is: A standard investing account with no contribution limits

Why it’s valuable:

No income restrictions

Full flexibility on withdrawals

Useful for early retirement, big purchases, or overflow investing

Tax tip: Use tax-efficient index funds or ETFs to minimize capital gains

✅ Use it for: flexible investing and goals outside retirement (like early FI)

🔁 How They Work Together

Think of these accounts as your system’s destinations. In upcoming lessons, you’ll build a money flow that feeds each one in the right order, automatically.

🧠 Quick Quiz

-

The HSA is the only account that offers all three tax benefits.

-

The taxable brokerage account.

-

The Roth IRA.

⏭️ Coming Up Next…

In the next lesson, you’ll learn which accounts to prioritize and how to align them with your monthly income.