How To Set Up Automatic Investing With Fidelity

In this step-by-step guide, I will walk through the steps to set up automatic investing with Fidelity. But before I do, I want to highlight the primary reasons I love to use automatic investing to help me reach my $10M FIRE goal by age 40.

💡 Want to follow along with real examples?

My free course shows you exactly how to set this up.

Reasons to Auto-Invest

Dollar-cost averaging (DCA). By consistently investing a fixed dollar amount every week or month, I get the sweet benefit of dollar-cost averaging. DCA is where, instead of investing a lump sum into the market all at once, you spread out that contribution over a period of time in the hopes of reducing the impact of market volatility.

Less stress. So many people are hung up by daily swings in the stock market. To me, that can be very, very stressful. By auto-investing, I don’t have to worry about that. My money just gets invested on a fixed schedule, no matter how high or low the market is. Since my investing horizon is long, I can leave my investments on auto-pilot more or less. I just have to keep an eye on the mutual funds I invest in by tracking their performance over the years and their expense ratios.

Out of sight, out of mind. Most people are tempted to spend money they see. By automatically withdrawing money out of my bank accounts, I don’t have much chance to spend extra income.

Lack of discipline. To invest consistently, one has to be disciplined to transfer money into a brokerage account and invest over time. Most people don’t have the time or habits to do this regularly and, therefore, miss out on potential growth by sitting on idle cash. By auto-investing, I don’t have to think about this anymore; my money just gets socked away into mutual funds on a regular basis.

Now that we know how powerful auto-investing can be, let’s walk through the motions to get it all set up!

Steps to Set Up Automatic Investing

1) Prerequisite alert! Before proceeding, I want to note that you can currently only auto-invest into mutual funds you already own. So if you don’t own any mutual funds yet, you’ll need to make a minimum investment into at least one mutual before you can get your automatic investments configured. For a list of my top picks, check out my 6 Reasons Why I Invest in Stocks blog post (scroll down to the table of funds).

2) Login to your Fidelity account and go to https://www.fidelity.com/cash-management/automatic-investments.

3) Click the “Set up Automatic Investments” button. It should take you to https://digital.fidelity.com/ftgw/digital/auto-invest, where you will see a list of your accounts.

4) Set up an automatic transfer or investment by clicking on the link for the account you wish to set up automatic investing for. From there, a dialog should appear with several options:

a) Transfer funds from an external bank account. This would simply transfer money from your bank account to your investment account, but it will not invest that cash upon transfer.

b) Transfer and then invest funds from an external bank account. This is the one I do. It performs (a) and automatically invests it in a mutual fund for me.

c) Invest funds from core position. This is a way to auto-invest funds already sitting in your investment account.

5) Transfer and then invest funds from an external bank account. For the purposes of this guide, I will proceed by selecting option 3b. Fidelity will then take you to the page to actually configure your auto-investing schedule. It should look something like this:

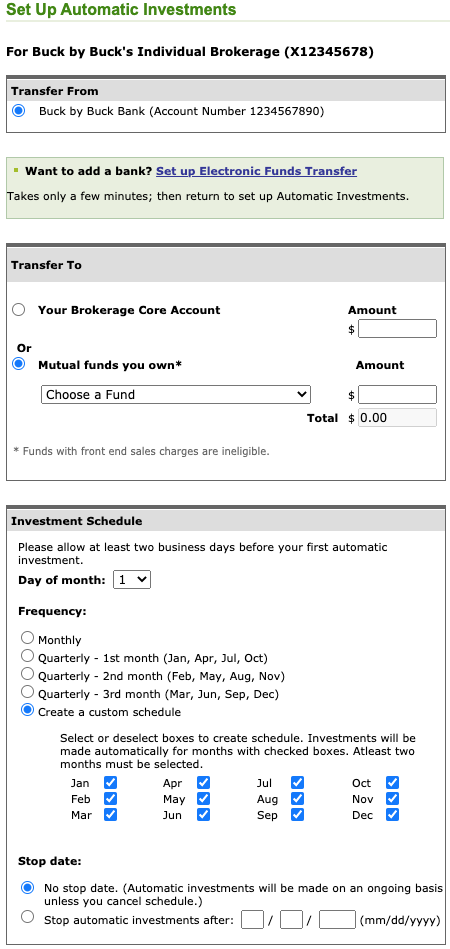

6) If you want to transfer funds from a bank account you haven’t used previously, you’ll need to go through Fidelity’s step-by-step instructions by clicking on the “Set up Electronic Funds Transfer” link. Once you add it, return to this page.

7) Transfer From. Select which bank you wish to transfer money from.

8) Transfer To. This section has two options:

a) Your Brokerage Core Account. If you select this, money will be transferred into your investment account but won’t be automatically invested. It will just sit there until you manually invest it yourself.

b) Mutual funds you own. This is what I use. Selecting this option will invest your transferred funds automatically into a mutual fund you own.

9) Enter an amount you want to automatically transfer & invest from your bank account. Be careful not to overextend yourself! You can always start small and increase this amount at a later point. The minimum amount you can auto-invest is $10.

10) Investment Schedule. This is where you can customize your auto-investing schedule. The frequencies available for your choosing only indicate monthly or quarterly, but you can actually get this down to daily or weekly if you really wanted to, by setting up multiple schedules!

a) To set up multiple schedules, you’ll have to repeat this process starting from Step 3. Personally, I have multiple schedules configured so I auto-invest $5,000 per week.

11) Click “Next.” Here, you get to review your schedule and finalize it. After you finalize your schedule, you can review, edit, and even skip specific months if you want.

12) Congratulations! That’s it. You’ve successfully set up your automatic investments!

My other popular guides:

Automatic Investments with E*TRADE: Step-by-step guide

Regular Backdoor Roth: Step-by-step guide

Mega Backdoor Roth: Step-by-step guide

Real Estate Evaluation: Use what I use to evaluate rental properties!

Disclaimers

All screenshots were taken in 2021 from Fidelity.com and may be subject to change.

This is not advice. Reach out to a tax/financial advisor for professional assistance.