How To Set Up a Mega Backdoor Roth With Fidelity

Editor’s Note: This post was originally published in 2021 and has been updated in January 2026 for accuracy.

In this step-by-step guide, I will walk through the steps to set up a Mega Backdoor Roth with Fidelity. Specifically, I will outline the steps to set up an Mega Backdoor Roth using an “in-plan conversion” (as opposed to the tedious and tax-ineffective “in-service conversion”).

My other popular guides:

Regular Backdoor Roth: Step-by-step guide

Automatic Investing: Set up your investments automatically (out of sight, out of mind!)

Real Estate Evaluation: Use what I use to evaluate rental properties!

Additionally, if you don’t know the differences between the regular Backdoor Roth and the Mega Backdoor Roth conversions, read my blog post first!

0. Prerequisites to set up a Mega Backdoor Roth

Your employer’s 401(k) plan needs to allow after-tax contributions. Without this option, you can’t do a mega backdoor Roth. Check with your employer’s HR team to find out if they offer this benefit.

Your employer’s 401(k) plan allows for “in-plan” rollovers to a Roth 401(k) or “in-service” withdrawals to a Roth IRA.

If neither is offered, you can’t touch your after-tax contributions in your 401(k). Therefore, your earnings would grow tax-deferred, not tax-free! In that case, I’d recommend avoiding the Mega Backdoor Roth altogether. It’s actually worse to invest after-tax dollars in a traditional 401(k) than a regular brokerage account because 401(k) withdrawals are taxed as ordinary income, not (long-term) capital gains!

Prerequisite #2: While there are 2 ways to set up a Mega Backdoor Roth, I will focus only on using the “in-plan conversion” method, which is the fully-automated approach and doesn’t come with the tax headaches that the “in-service conversion” method does.

1. Login to your Fidelity 401(k)

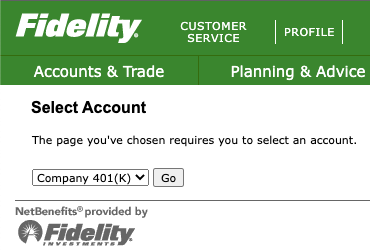

a) Click here and login using your Fidelity.com credentials. You should land on a page that asks you to select which account you want to modify. Select your company’s 401(k) plan from the dropdown.

2. Change contribution amount

a) You’ll be taken to a page with a section that says, “Manage Your Contribution Amount.” Click the link called “Contribution Amount.” You’ll find yourself on a page that allows you to change your “Contribution Amount per Pay Period”:

Note: This page may look different for you, depending on what kind of 401(k) deferral plans are offered to you. If there is no “After Tax Deferral” section, then unfortunately, your employer doesn’t offer the Mega Backdoor Roth benefit. You can always opt to do the regular Backdoor Roth.

b) Here’s where the magic happens.

The Pretax Deferral section is for your normal pre-tax traditional 401(k). The max contribution limit here is $24,500 in 2026.

The Roth Deferral section is for normal post-tax Roth 401(k) deferrals. I don’t contribute anything here because I prefer maxing out my pre-tax traditional 401(k) to lower my taxable income today.

The After Tax Deferral section is where you set up your post-tax Mega Backdoor Roth contributions!

How much you can contribute is calculated using the following formula:

In 2025: Max Mega Backdoor Roth contributions = $70,000 - (employee 401(k) contributions) - (employer match contributions)

In 2026: Max Mega Backdoor Roth contributions = $72,000 - (employee 401(k) contributions) - (employer match contributions)

For example, in 2026, if you max out your traditional 401(k) at $24,500 and your employer match contributions are $15,000, then your max Mega Backdoor Roth contributions would be $39,500. That is, $72,000 - $24,500 - $15,000 = $39,500.

3. Call Fidelity for automatic Roth in-plan conversions

This step is simple. Just call Fidelity Workplace Planning at 800-557-1900, and tell them you’d like to add “Automatic Roth In-Plan Conversion” to your account. If the person who answers happens to not know how to do that, just call them again later.

Warning: If you don’t do this step, your after-tax contributions will sit in your traditional 401(k)! That is very bad for tax & penalty reasons.

4. Verify your Mega Backdoor is set up

a) After you receive your next paycheck, log back into fidelity.com.

b) Click on your 401(k) account.

c) In the main area of the page, you will see an “I Want to…” section. Click on “View Balances.”

d) You should see a pie chart called “Sources.” For example:

If you see “Roth In-Plan Conversion” in the legend, you’re all set! If not, be sure to double check all previous steps. Call Fidelity if you’re still having trouble.

5. Congratulations!

That’s it. You’ve successfully set up a Mega Backdoor Roth! Now you can start watch your post-tax contributions grow tax-free!

If you’re interested in learning about another way to grow even more of your investments tax-free, read my other step-by-step guide to do a regular Backdoor Roth! I’ve also created a guide on how to setup automatic investing, as well.

Disclaimers

All screenshots were taken in 2021 from Fidelity.com and may be subject to change.

Mega Backdoor Roth conversions are sanctioned by the IRS as of 2026, but they may close them off in the future.

401(k) contribution limits may differ in future years.

This is not advice. Reach out to a tax/financial advisor for professional assistance.

✅ Ready to automate your money and invest with confidence?

My free course shows you how to build a hands-off system that runs itself.