How To Set Up Automatic Investing With E*TRADE

In this step-by-step guide, I will walk through the steps to set up automatic investing with E*TRADE. But before I do, I want to highlight the primary reasons I love to use automatic investing to help me reach my $10M FIRE goal by age 40.

💡 Want to follow along with real examples?

My free course shows you exactly how to set this up.

Reasons to Auto-Invest

Dollar-cost averaging (DCA). By consistently investing a fixed dollar amount every week or month, I get the sweet benefit of dollar-cost averaging. DCA is where, instead of investing a lump sum into the market all at once, you spread out that contribution over a period of time in the hopes of reducing the impact of market volatility.

Less stress. So many people are hung up by daily swings in the stock market. To me, that can be very, very stressful. By auto-investing, I don’t have to worry about that. My money just gets invested on a fixed schedule, no matter how high or low the market is. Since my investing horizon is long, I can leave my investments on auto-pilot more or less. I just have to keep an eye on the mutual funds I invest in by tracking their performance over the years and their expense ratios.

Out of sight, out of mind. Most people are tempted to spend money they see. By automatically withdrawing money out of my bank accounts, I don’t have much chance to spend extra income.

Lack of discipline. To invest consistently, one has to be disciplined to transfer money into a brokerage account and invest over time. Most people don’t have the time or habits to do this regularly and, therefore, miss out on potential growth by sitting on idle cash. By auto-investing, I don’t have to think about this anymore; my money just gets socked away into mutual funds on a regular basis.

Now that we know how powerful auto-investing can be, let’s walk through the motions to get it all set up!

Steps to Set Up Automatic Investing

1) Prerequisites. E*TRADE allows you to auto-invest into both index funds and mutual funds, unlike Fidelity which currently allows mutual funds. For a list of my top picks, check out my 6 Reasons Why I Invest in Stocks blog post (scroll down to the table of funds).

2) Login to your E*TRADE account and go to https://us.etrade.com/etx/pxy/automaticinvesting#/.

3) Click the “View current plans” button. It should take you to https://us.etrade.com/etx/pxy/automaticinvesting#/dashboard, where you will see a list of your automatic investment schedules.

4) Click the “Create new plan” button. Select the account you want to set up automatic investing for.

5) Select which index and mutual funds to invest in. Check the boxes next to each fund you want to invest in or search for funds you don’t currently own (see example below). Just beware that mutual funds have minimum investment requirements.

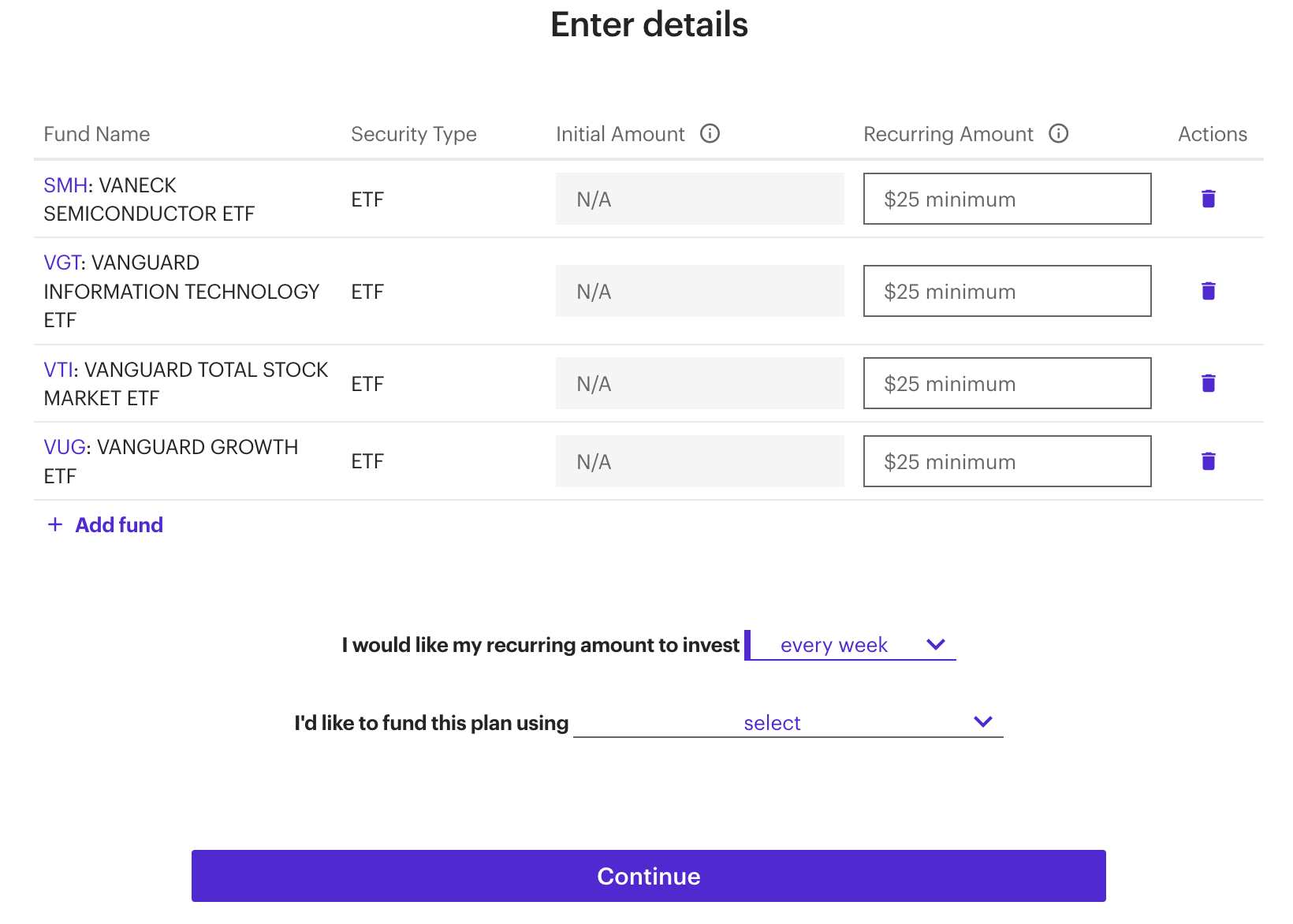

6) Configure your recurring investment schedule, dollar amounts, and account to fund this investment plan. Set a dollar amount for each fund you selected in the previous step. Then, determine the frequency you want to invest in these funds. Lastly, select which account you will be funding this investment plan with. See below example.

Be careful not to overextend yourself! You can always start small and increase this amount at a later point. The minimum amount you can auto-invest into each fund is $25.

Remember that you can create multiple schedules that are tailored to your financial needs.

7) Click “Continue.” Here, you get to review your schedule and finalize it. After you finalize your schedule, you can review, edit, or pause your schedules.

8) Congratulations! That’s it. You’ve successfully set up your automatic investments!

My other popular guides:

Automatic Investments with Fidelity: Step-by-step guide

Regular Backdoor Roth: Step-by-step guide

Mega Backdoor Roth: Step-by-step guide

Real Estate Evaluation: Use what I use to evaluate rental properties!

Disclaimers

All screenshots were taken in 2024 from Etrade.com and may be subject to change.

This is not advice. Reach out to a tax/financial advisor for professional assistance.