My 2025 Spending Review

Hey everyone. Long time no see! Usually, my year-end reviews focus on how my investments performed, whether I plan to rebalance or reallocate them, and how my personal goals fared. However, today I’m simply going to focus on credit card spending, because it surprised even me once I looked at our annual credit card spending reports. Let’s take a look!

Credit Card Spending Summary

In 2025, we spent $134,425.90 with our credit cards. We have 3 primary credit cards in our household: Costco Citi Visa, Chase Amazon Visa, and Chase Sapphire Preferred Visa. Below is a breakdown of how we use each card, how much we spent on each one, and the cash back or points we received last year:

| Card | Usage | $ Spent in 2025 | Cash Back or Points Earned |

|---|---|---|---|

| Costco Citi Visa | Primarily used at Costco, restaurants, and occasionally for travel-related expenses | $27,095.25 | $641.14 |

| Chase Amazon Visa | Only used for Amazon and Whole Foods purchases | $14,879.49 | 84,423 points |

| Chase Sapphire Preferred Visa | Most travel-related expenses + everything else | $92,451.16 | 147,893 points |

Whenever possible, we like to keep things simple in our household. Using our credit cards is pretty straightforward. We simply follow the usage rules outlined in the table above, and we’re more than likely to receive the most points or cash back. When in doubt, we just swipe the Chase Sapphire Preferred Visa since it’s pretty good for almost anything.

Expenses by Category

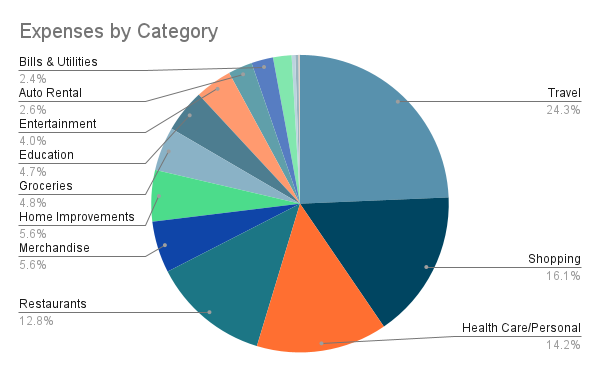

The year’s worth of expenses is bucketed into the following categories:

Restaurants: $17,175.26

Auto Rental: $3,537.28

Health Care/Personal: $19,108.81

Services: $530.53

Merchandise: $7,538.55

Shopping: $21,690.92

Automotive: $2,702.96

Entertainment: $5,378.14

Travel: $32,705.38

Bills & Utilities: $3,178.69

Groceries: $6,400.15

Gas: $138.77

Fees: $95

Education: $6,288.20

Gifts and Donations: $450.07

Home Improvements: $7,507.19

The biggest buckets were travel, shopping, health and personal care, and restaurants. Most of them are easily explained, except the travel category. Spending $32,705.38 on travel in a single year is no joke. Our normal range is between $20-25K. However, I made 5 unplanned trips to California that were unavoidable, most of which were quick turnaround trips, and an additional half-week trip to Oregon. Plus, the family traveled to the Cayman Islands for a week, Yellowstone/Grand Tetons/Glacier National Parks for 2.5 weeks, and Costa Rica for 2.5 weeks.

All in all, last year was very likely the most we’ve traveled, which definitely tired us out. We’ve committed to traveling fewer days this year, but our travel expense is undoubtedly going to rise due to a costly international trip this summer (probably $35-40K alone).

Cash Back and Points

When I was younger, I tried to find the credit cards with the highest cashback or points rewards, along with sign-on bonuses (e.g., spend $5K in the first 3 months to receive $500 back). But those days are gone now, with simplicity being a higher priority for me. With just 3 primary credit cards, I’ll break down how and why we used them last year.

Costco Citi Visa

We use our Costco Citi Visa primarily at Costco, restaurants, and for a few travel expenses. Earning $641.14 back after spending $27,095.25 means we earned back 2.37%. Since Costco’s Executive membership costs $130 per year, we definitely made good use of it.

Amazon Visa

Using our Amazon Visa strictly for Amazon and Whole Foods (owned by Amazon, if you weren’t aware) purchases gives us at least 5% back. We earned 84,423 points after spending $14,879.49 last year. That comes out to a 5.67% discount. After seeing a return above 5%, the only way I think that’s possible is by making strategic purchases on Amazon that give 6 or 7% cash back, usually by opting to delay shipments.

Chase Ultimate Rewards Points Hack

First off, every Chase Ultimate Rewards point is worth about a penny. So 100 points = $1. But instead of trading points for dollars, I prefer saving them up and spending them on gift cards that are sold in the Chase Ultimate Rewards center. There, you will frequently find gift cards that are 10% off or more. My favorite one is DoorDash since we are dedicated customers. So I’ll wait for 10% off sales on gift cards to stretch my points even further. For example, we earned 147,893 points last year on our Chase Sapphire Preferred card. Trading that in for dollars would come to $1,478.93. Instead, I could buy a little more than $1,600 worth of gift cards at 10% off.

Excluded Expenses

As a reminder, we spent $134,425.90 on credit cards alone. While we try to put as many purchases on credit cards as possible to earn cash or points back, not everything accepts credit cards, or if it does, it charges fees I’m unwilling to pay.

The main 2 expenses that aren’t paid by credit card are housing and various insurances. Housing expenses include my mortgage, property taxes, HOA fees, and insurance, totaling roughly $58,000 per year. We also have auto and umbrella insurance policies totaling approximately $5,000 per year.

Next Up

If we sum up our credit cards, housing, and insurance expenses, we get roughly $197K for the year. One of my future goals is to cover our total expenses with just passive income. No W2 or withdrawals necessary. Investment growth is ignored. Retirement accounts are completely ignored. In an upcoming post, I will talk about how I plan to meet that goal, hopefully in the near future!

Hopefully, you’ll see more of me this year. And please comment below or email me directly if you have any questions or topic requests. I am actually quite responsive!