Investing in a Pre-Construction Fourplex

For years, I’ve been interested in a unique real estate investment model in which investors buy turnkey fourplexes before they’re built. This allows investors to buy a property at a lower price than they would pay for a finished building. However, for the past 10 years, I have miraculously found an excuse not to pull the trigger. But finally, last year I took the plunge! In this post, I’ll share with you how the process works and what the numbers look like.

How Investing in Pre-Construction Fourplexes Works

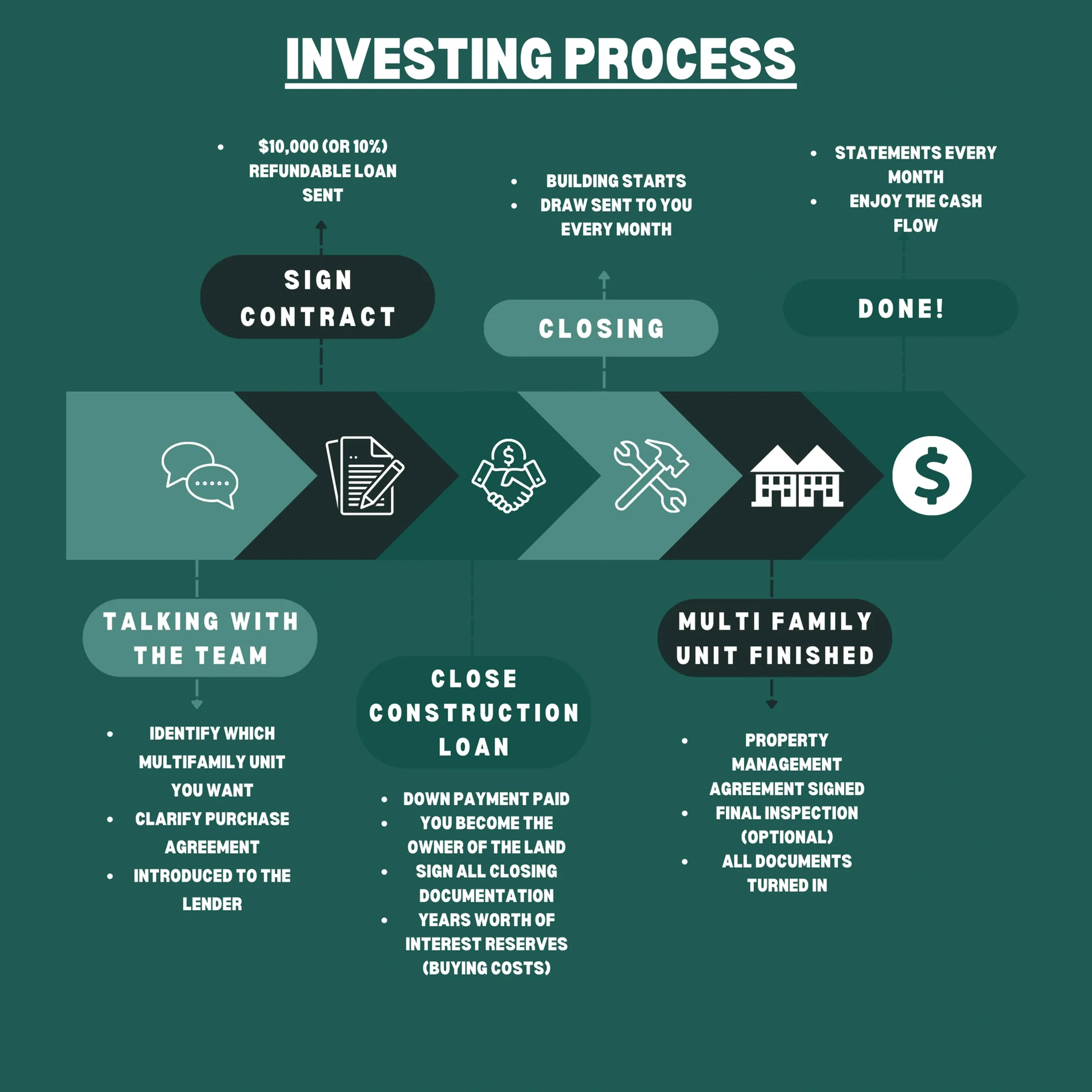

Here’s a quick rundown:

Analyze proformas. Do the numbers make sense? Is it worth the risk and investment?

Sign a purchase agreement. Wire a deposit of $10k or 10% of the investment.

Get a construction loan. This loan will help pay for the construction of your fourplex. The builder will supply one to you. Unfortunately, construction loans tend to have higher interest rates, usually 2% higher than a standard 30-year fixed mortgage.

Build the fourplex. The builder handles all of this for you. They just request money every so often to pay their workers over the course of about 9-12 months. Each time they request money, this pulls from your construction loan. Every time they withdraw money from your loan, that amount begins accruing interest.

Rent it out. Again, the builder handles this for you. They partner with a property management company, which will market and lease your units on your behalf.

[Optional] Refinance: Since the construction loan has a high interest rate and likely balloons (must be paid in full) after a set period of time (between 6-24 months since inception), once the building is complete, you will refinance it into a typical mortgage.

Go on cruise control. This type of investing is usually turnkey. So, all of this process is mostly hands-off, aside from signing documents every so often and possibly going through a refinance out of the construction loan. After it’s built, the property manager will handle almost everything for you.

What the Numbers Look like

Alright, so that’s the gist of how this pre-construction investment model looks. Now, let’s look at some concrete numbers for the fourplex I’m building in Indiana to make this clearer.

Numbers With a Construction Loan

Purchase price: $1 million

Buying costs (closing costs, construction loan interest, title fees, etc.): $68,875

Down payment (25%): $250,000

Monthly breakdown:

Mortgage post-refinance (6% interest): $4,500

Rent per unit: $2,200 = $8,800

Operating expenses (vacancies, repairs, etc.): $2,945

Cash flow: $1,355

Yearly summary:

Cash flow: $16,260

Cash-on-cash return: ~5.1%

This is calculated by dividing the annual profit by the total cash invested in the investment. So, $16,260 divided by ($250K down payment + $68,875 in buying costs).

It doesn’t take into account the home's appreciation value, write-offs, etc.

Numbers Without Loans

I actually didn’t go down the construction loan route. Instead, I paid for the entire construction with cash, helping me avoid quite a lot of the buying costs. Here’s what my numbers came out to:

Purchase price: $985,000 (I negotiated this down from the original $1 million pricetag)

Buying costs (closing costs, construction loan interest, title fees, etc.): $6,083

Monthly breakdown:

Rent per unit: $2,200 = $8,800

Operating expenses (vacancies, repairs, etc.): $2,945

Cash flow: $5,855

Yearly summary:

Cash flow: $70,260

Cash-on-cash return: ~7.13%

All in all, going all-cash saved me about $62,792 in buying costs. I am considering refinancing to get my cash out, but I haven’t decided to do so quite yet. Rates are just at the point where they’re looking somewhat attractive, but I’m still longing for 2021 interest rates!

Also, if you compare the numbers between the construction loan + refi with the all-cash route, you’ll notice that the cash-on-cash return improved 2% by going all-cash.

What’s Next

If you’re curious to learn more about this unique real estate investment model, comment below or contact me directly! Stay tuned for my next blog post, where I’ll discuss how this fourplex fits into my financial goal of generating enough passive income to cover my expenses. In a subsequent post, I’ll compare this Indiana fourplex’s numbers with a fourplex I purchased in Missouri back in 2017. It’s certainly an eye-opener to see how quickly real estate investing has changed over the past decade!