How I Turned My 2nd Flip Into My 1st Airbnb

At the start of 2021, I set out to start an out-of-state flipping business and flip an average of 1 home per quarter (4 for 2021). By May, I had already purchased all 4 of my flips for the year. The 2nd home I purchased, however, didn’t get remodeled on schedule, nor did it attract a sale price I was happy with. So instead of waiting around hoping for a magic sale to happen, I decided to convert my 2nd flip into an Airbnb! In this post, I’ll talk about what went wrong with my 2nd out-of-state flip and the steps I took to convert this property into an Airbnb.

Why My 2nd Flip Went Flop

At the end of March, I purchased my 2nd out-of-state flip. Unfortunately, I didn’t line up a contractor in time to start immediately after I purchased it. It took an extra 2 weeks for me to finalize a contractor I felt comfortable with. The rehab project began in the middle of April and was estimated to complete by the middle of June (~2-month project).

Fast forward to June, and the rehab was still not complete. In July, I pushed my realtor to list the home for sale, despite there still being several last minute items (e.g. install 2 shower glass doors that were backordered) to complete. Why didn’t I just wait for everything to be finished? Well, those remaining items weren’t major, and if a buyer was nervous about them getting completed, we could easily write them into their purchase contract. Lastly, 3.5 months had passed, and I only had 2.5 more months remaining on my 6-month hard money loan. For the sale of a home, a typical close time is around 40-45 days (about 1.5 months). That only left me with a month to market and sell the home. I thought that a month would be more than enough time to sell the home. Boy, was I wrong.

July 2021 was an interesting time to sell in this particular neighborhood, as there were roughly 10 other listings on the market for some reason. There were also fewer buyers on the market since many families tend to be out on vacation while school is out. We originally priced the home for $625,000. After a week and a half of absolutely zero interest, we dropped the price $26K down to $599,000. With 2 open houses per weekend, we still attracted no buyers. Why? Well, the competition was lowballing the market and was really hurting sale prices! After trying to sell my home for 3 weeks, I decided to take matters into my own hands and delisted the property. No sale? Alright, fine. I’ll pivot and make a profit another way!

Long-Term vs Short-Term Rental

Historically, I’ve only ever owned long-term rentals. So naturally, I researched how much rent my property would rake in. Long story short, it seemed like a long-term rental would yield me at most enough rent to cover my costs - a breakeven point.

Breakeven is never enough for an investor, so I then decided to look into short-term rental options. I had zero experience with short-term rentals, so I reached out to 3 different property management companies to see what they thought my property would receive in rental revenue for the year. And good thing I reached out to multiple companies because the estimates were all over the place!

I ended up going with the one in between the very conservative and the overzealous estimates. If my property manager is right, I should be pulling in roughly $78,000 in gross annual revenue, which should definitely more than cover the cost to own and operate the property. We’ll see how the next year or two play out! I’m excited to capture all the numbers over time and share them with you!

Logistics and Paperwork

Since this property was slated to be a flip, I had taken out a hard money loan on the property that had a 6-month term. By the time I decided to convert the home into an Airbnb, more than 4 months had passed. That meant that I had to refi out of the hard money loan into a conventional Fannie Mae/Freddie Mac loan in under 2 months.

After reaching out through my network, I decided to work with a lender one of my realtors had referred. They were fantastic and closed on my refi in about 3 weeks with a 4% interest rate. Considering this was an investment home, which has higher rates than primary homes, I was pleased with the rate I received.

After owning the home for a total of 5 months, I had gotten out of the hard money loan which is essentially a 6-month ticking time bomb. Phew! And with a conventional 30-year fixed mortgage, I’d drastically lowered my monthly holding costs (the hard money loan's interest rate was nearly 10%) and I can now rent it out for the next 30 years.

Next up was what I’d consider the fun part: getting the home furnished and decorated to be rented as an Airbnb.

Furniture and Decor

There were 3 main ways for me to furnish and decorate the home:

DIY: I could buy all the furniture and decor myself, build and hang everything, etc. This was the cheapest option numbers-wise but most expensive in terms of spending my time & energy.

Because I had staged the home to try to sell it, my stager was willing to sell me all the furniture and decor they had used. The prices were reasonable, but overall, the pricing was more expensive than the DIY option. Additionally, the amount of furniture the stager would provide was not sufficient to fully furnish the home, nor was it brand new.

Several companies, including short-term property management companies, offer services to do everything on your behalf. This is essentially a turn-key option for setting up a short-term rental. Clearly, this was the priciest option.

I decided to spend my time and energy and went with the DIY option. Once I decided to do this, I went into hyperdrive and got organized.

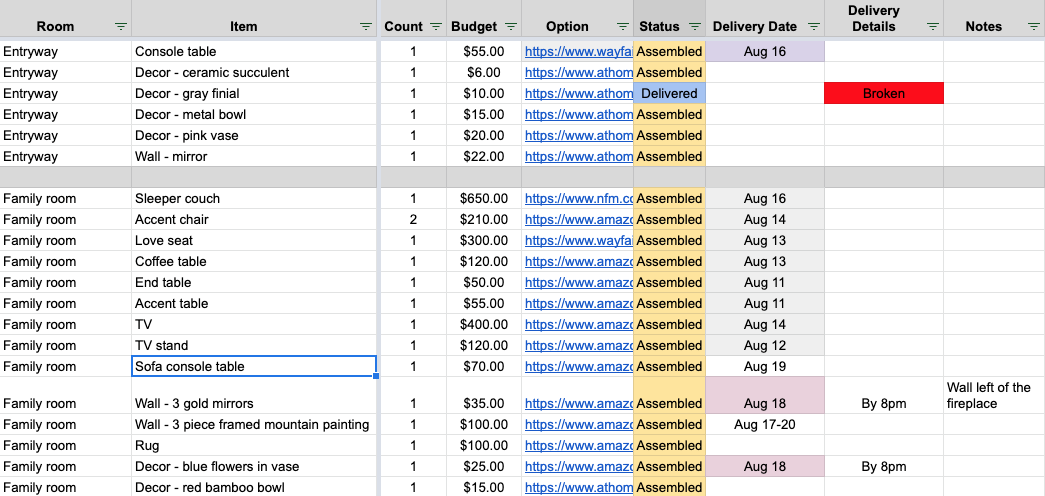

This spreadsheet is how I tracked all the items I purchased and assembled in my AirBnb.

I created a spreadsheet to track all the items I needed to purchase, assemble, hang, etc., when each item would arrive, and which room they’d ultimately reside in the house. See a screenshot of a sliver of the entire spreadsheet just above.

I booked a roundtrip flight to go set up the place and get a feel for what it would be like to be a guest there. I had to carefully order specific items from specific stores depending on their price, availability, and delivery times, because I needed everything to be delivered either before or during my stay at the property. My goal was to get the property in a rentable state by the time I left.

Before my arrival, I coordinated with some of my contacts in the area, including my new property manager, to help me track deliveries, take them into the specified room in the house, and drop off tools for me so I could build furniture immediately upon my arrival. Some of my contacts were even kind enough to start building a few difficult items since they knew I wasn’t too handy! In particular, I needed them to build a bed and install a shower rod so I would have somewhere to sleep and shower once I arrived.

I had to purchase & coordinate with Best Buy to deliver and install a washer/dryer set and new refrigerator before my arrival so I’d be able to use them while I lived there. I was initially eyeing open box (preowned) appliances, but I ultimately went with new ones because only new appliances were delivered & installed by the stores. If I went with open box appliances, I would’ve had to hire someone to pick it up in-store, transport it, install it, etc. It just wasn’t worth it. Plus, I ended up with new appliances so hopefully the maintenance cost would be lower in the long-term.

During my 10-day stay at the property, I built all the furniture (with a bit of help from friends in the area), hung all the decor, cleaned the majority of the home (except the floors), and washed all the brand new towels and linens. Most of my items were purchased online through Amazon and Wayfair Professional. Both of them had very reasonable prices and, of course, reliable delivery times. Wayfair Professional also offered a dedicated associate for my business to help me get discounts since I was purchasing so many items. Overall, I was very pleased with the resulting look and feel of the home! A few pieces of furniture I bought weren’t high quality, so we’ll see how long they last, especially since there will be a high turnover of guests.

My Airbnb’s kitchen and breakfast nook

The cost of furnishing my 4 bedroom, 3.5 bathroom property was approximately $17,000 to purchase nearly 250 different items to fully furnish and decorate the home, including buying a brand new refrigerator, dishwasher, and a washer/dryer set. I’m hopeful that rent will cover the cost after a year. Fingers crossed!

Listing the Property on Airbnb

As I mentioned earlier, before I decided to convert my flip into an Airbnb, I spoke with 3 property managers to get a better understanding of the listing process, their annual rent estimates for my property, and what their management style was like:

The 1st one indicated a very low nightly rate, one that would mean converting my property into an Airbnb would not make financial sense.

The 2nd provided me with nightly rates that landed in between the 1st and 3rd property management companies’ estimates. They had superb communication skills and didn’t seem like too big of a company.

The 3rd company gave me outrageous estimates that turned me off because they seemed to be baiting me.

At the end of the day, I went with the 2nd property management company and I have been very pleased with them thus far! They’ve been very communicative, supportive, and organized. I couldn’t ask for much more, to be honest. Only time will tell how well they handle guests, my home, and the profits.

To set up the Airbnb listing, all I had to do was create a shell listing on Airbnb’s website, so that I was the actual owner of the listing. From there, I granted my property manager co-ownership of the listing so they can do the rest of the work like uploading professional photos, dynamic pricing, and communicating with guests.

Private queen bedroom

Some other property management companies will own your listing on Airbnb. The problem with that is if you decide to split ties with them, your listing, its reputation, all the photos, etc. will go away. My property management company strongly advised me to own the listing in case I want to use another company in the future.

What’s Next

I had to wrap up a few last minute rehab items before giving my property manager the green light to schedule deep cleaners, photography, and make the Airbnb listing live. At the time of writing, the only thing left is to upload photos and polish up the Airbnb listing before inviting guests to stay at the property. How exciting!

I am eager to watch how well (or poorly) this Airbnb performs over time. In order to judge it, though, I will need to list it for at least a year or two. A year’s worth of profits should theoretically cover the costs to furnish and decorate it. Keeping this home as a short-term rental for at least 2 years should be enough time for me to evaluate if I like listing my rentals on Airbnb or if long-term rentals suit my investment style better. Stay tuned for more on this topic in the future!